Three U.S. economists win Nobel Prize for work on financial crises

The laureates’ work highlights both the necessity and instability of banks in the modern economy

O. Rose Broderick • October 10, 2022

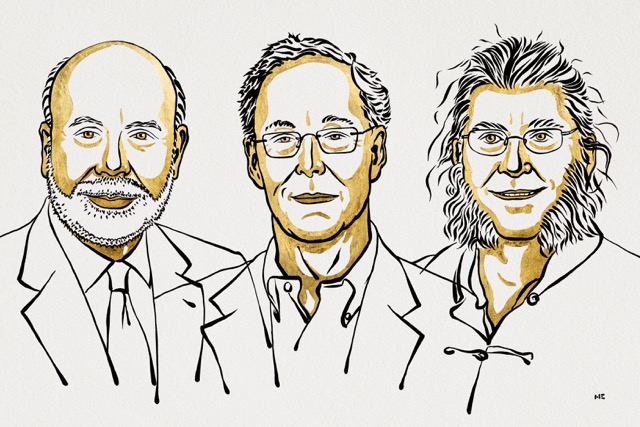

Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig, winners of The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022. [Credit: Niklas Elmehed © Nobel Prize Outreach 2022]

Three U.S.-based economists were awarded the 2022 Sveriges Riksbank Prize in Economic Sciences — colloquially called the Nobel Memorial Prize — for their work on banks and financial crises.

Ben Bernanke, Douglas Diamond and Philip Dybvig published research in the early 1980s that would eventually inform reactions to the 2008 financial crisis and ensuing Great Recession. They showed banks can be tremendously useful, but the banks’ stability is predicated on sound regulations.

“Fifteen years ago, much of the world stood at the brink of a devastating economic crisis,” said Hans Ellegren, secretary general of the Royal Swedish Academy of Sciences. “Most of us were unprepared for it. However, a few academic economists were both prepared and worried.”

Bernanke, a senior fellow at the Brookings Institute and former chair of the Federal Reserve, published a 1983 paper that analyzed the Great Depression and showed that bank runs — when many people withdraw money simultaneously — heightened and prolonged the worst economic crisis in modern history. Bernanke oversaw the Fed during the Great Recession and used the knowledge gleaned from his research to keep the crisis from further spiraling into a financial depression.

Diamond, a University of Chicago professor, and Dybvig, a Washington University in St. Louis professor, also demonstrated that banks perform a critical role in a functioning economy. Their research showed banks can translate savings into investment, but this power can be threatened by rumors of an imminent banking collapse.

“Financial crises become worse when people start to lose faith in the system,” said Diamond during a press conference at the Nobel award ceremony. “So in periods when things happen unexpectedly … that can be something that sets off some fears in the system.”

This award arrives amidst a coronavirus pandemic that destabilized the global economy and increased fears of another recession. Thankfully, Diamond says, we’re much better prepared.

“Before the 2008 financial crisis, there wasn’t a general perception in the financial sector and in the regulatory community that there was an unusually high vulnerability to the sector,” he said. “The recent memories of that crisis and improvements in regulatory policies around the world have left the system much, much less vulnerable.”